China was the main driver of growth in the global semiconductor equipment sector in 2023 and 2024, thanks to large investments by Chinese companies that rushed to buy machinery to avoid running out of stock due to US sanctions. According to data from the TechInsights platform, China bought equipment worth $41 billion last year, which gave it a 40% share of the global market.

However, Chinese consumption is expected to decline slightly in 2025 to about $38 billion, with a share of 20%. US sanctions, introduced in 2020, have limited the export of advanced technologies to China, which has given Beijing an additional incentive to develop domestic production and reduce its dependence on foreign suppliers. Chinese companies such as SiCarrier are working intensively to expand their range of production equipment, trying to catch up with global leaders.

Although Chinese manufacturers have significantly increased their share, from 5.1% in 2020 to 11.3% last year, they still cannot compete with the most advanced technologies, especially in the field of lithography systems for chip production below seven nanometers. The main manufacturer of such machines, the Dutch ASML, has suspended deliveries of the most sophisticated EUV systems to China under US pressure.

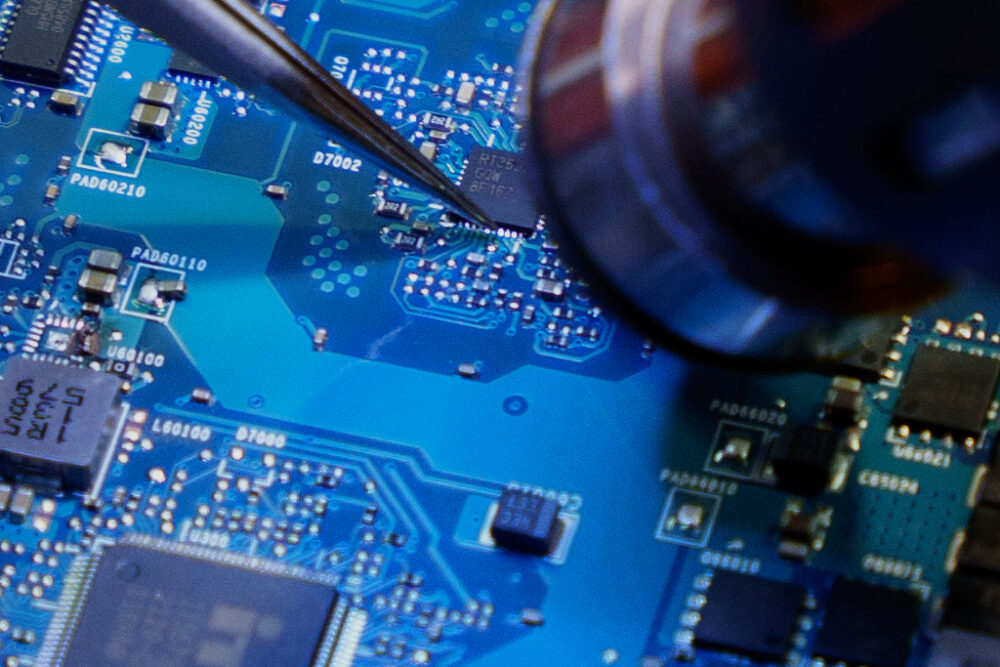

Chinese companies currently use less advanced DUV lithography technologies, and the only Chinese lithography machine manufacturer, Shanghai Micro Electronics Equipment Group (SMEE), offers systems for chip production at 90 nanometers, which lags behind global standards. Nevertheless, Chinese toolmakers for other parts of the manufacturing process, such as cleaning and deposition, have made significant progress, with companies such as Naura and AMEC recording strong growth and strengthening domestic production.

Overall, China is rapidly strengthening its semiconductor equipment industry, but still faces challenges in achieving technological self-sufficiency at the highest level, while global trade and technology relations remain dynamic and subject to change.